Basic savings accounts at traditional banks will earn you the least money. These accounts often offer minimal interest rates.

Basic savings accounts are common, but their interest rates are notably low. Traditional banks often provide these accounts with rates ranging from 0. 01% to 0. 05%. Despite being convenient and safe, these accounts do not significantly grow your savings over time.

Many people choose them for their security and ease of access, not for their earning potential. It’s essential to explore other options like high-yield savings accounts, credit unions, or online banks. These alternatives often offer better interest rates, helping your money grow faster. Always compare different accounts to find the best fit for your financial goals.

Introduction To Savings Accounts

Savings accounts help you save money safely. They also earn interest over time. Some savings accounts earn more interest than others.

Importance Of Savings

Savings are crucial for your future. They provide a safety net for emergencies. They also help you reach your financial goals.

- Emergency fund for unexpected expenses

- Financial goals like buying a house or car

- Peace of mind knowing you have savings

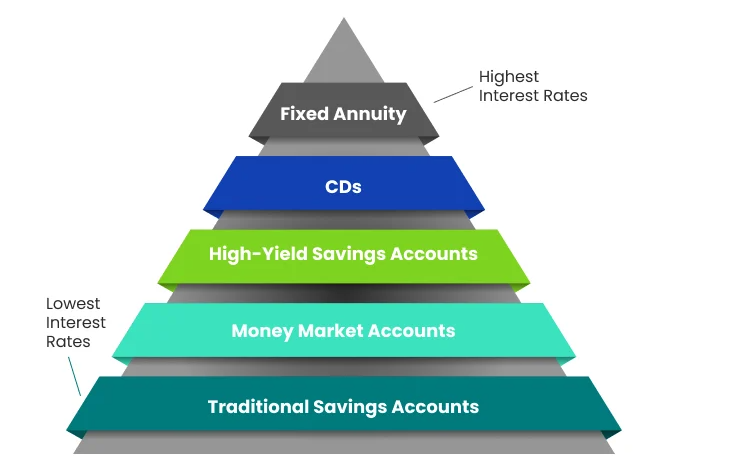

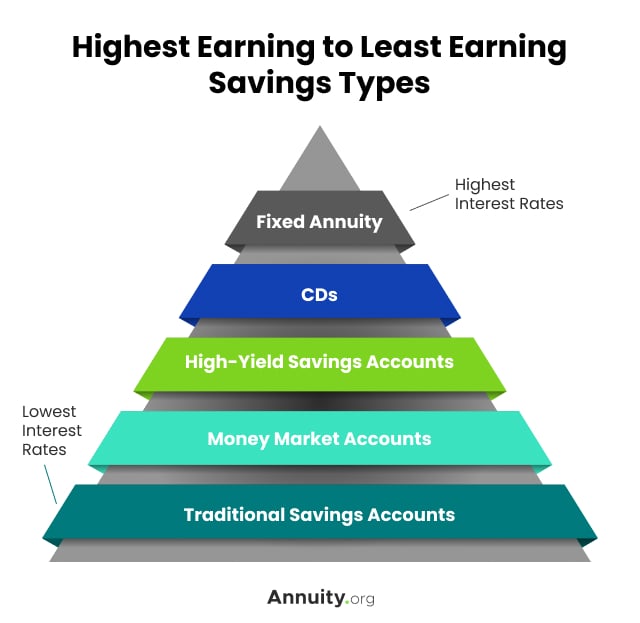

Different Types Of Savings Accounts

There are various types of savings accounts. Each has unique features and benefits.

| Type of Account | Interest Rate | Access to Funds |

|---|---|---|

| Basic Savings Account | Low | Easy |

| High-Yield Savings Account | High | Easy |

| Money Market Account | Medium | Limited |

| Certificate of Deposit (CD) | High | Restricted |

Basic savings accounts usually offer the least interest. They are good for easy access to your funds. High-yield savings accounts offer more interest. Money market accounts and CDs provide even higher rates.

Factors Affecting Savings Account Earnings

Choosing the right savings account can be tricky. Many factors impact how much money your account earns. Understanding these factors helps you make better decisions.

Interest Rates

The interest rate is the most important factor. It tells you how much your money will grow. A higher interest rate means more earnings.

Banks offer different interest rates. Some banks offer very low rates. This means your money grows slowly. Always compare rates before choosing a bank.

Fees And Charges

Fees can eat into your earnings. Some savings accounts charge monthly fees. Others charge for withdrawals or transfers. These fees reduce your total savings.

Look for accounts with no fees or low fees. This helps you keep more of your money. Always read the fine print to avoid surprise charges.

Account Terms And Conditions

The terms and conditions of an account also affect your earnings. Some accounts require a minimum balance. If you don’t meet this balance, you might pay fees.

Other accounts limit the number of withdrawals you can make. Exceeding this limit can result in fees. Always understand the terms and conditions before opening an account.

| Factor | Impact on Earnings |

|---|---|

| Interest Rates | Higher rates mean more money earned |

| Fees and Charges | Fees reduce your overall savings |

| Account Terms | Terms can limit your access to funds |

By understanding these factors, you can pick a better savings account. This ensures you earn the most money possible.

Low-yield Savings Accounts

Low-yield savings accounts are known for their minimal interest rates. These accounts provide safety but offer limited returns. They are ideal for short-term goals or emergency funds. Let’s explore two common types of low-yield savings accounts.

Basic Savings Accounts

Basic savings accounts are offered by most banks. They are simple and easy to open. Interest rates for basic savings accounts are very low. You can expect rates around 0.01% to 0.05%.

Features of Basic Savings Accounts:

- Easy to open with low minimum balance requirements.

- Limited transactions per month, usually up to six.

- Minimal monthly fees, often waived with balance requirements.

Traditional Bank Savings Accounts

Traditional bank savings accounts are also low-yield. They are similar to basic savings accounts but may offer more services. Interest rates here are also very low, typically 0.01% to 0.10%.

Features of Traditional Bank Savings Accounts:

- Access to in-person banking services.

- Often linked to checking accounts for easy transfers.

- Higher fees but more banking options.

| Account Type | Interest Rate | Main Features |

|---|---|---|

| Basic Savings Account | 0.01% to 0.05% | Low minimum balance, limited transactions, minimal fees |

| Traditional Bank Savings Account | 0.01% to 0.10% | In-person services, linked accounts, higher fees |

High-yield Alternatives

Finding a savings account that maximizes your earnings can be challenging. Traditional savings accounts often offer low interest rates. Luckily, there are high-yield alternatives available. These accounts provide better returns on your savings.

Online Savings Accounts

Online savings accounts typically offer higher interest rates. They have lower overhead costs compared to brick-and-mortar banks. Many online banks pass these savings to their customers.

- Higher interest rates

- 24/7 account access

- Low or no fees

Look for an FDIC-insured online bank. This ensures your money is protected. Some popular options include:

| Bank Name | Interest Rate |

|---|---|

| Ally Bank | 2.10% |

| Marcus by Goldman Sachs | 2.00% |

Credit Union Savings Accounts

Credit unions are member-owned financial institutions. They often provide better rates on savings accounts. Credit unions aim to benefit their members, not shareholders.

- Higher interest rates

- Lower fees

- Personalized customer service

Joining a credit union usually requires a small membership fee. They often have specific membership criteria. Check if you qualify for membership at a local credit union.

| Credit Union Name | Interest Rate |

|---|---|

| Navy Federal Credit Union | 1.75% |

| Alliant Credit Union | 1.85% |

Consider these high-yield alternatives to maximize your savings. Both online savings accounts and credit union savings accounts offer competitive rates.

Comparing Interest Rates

Choosing the right savings account is crucial. Interest rates can greatly impact your earnings. Let’s delve into various rates to understand which accounts yield the least money.

National Average Rates

The national average interest rate for savings accounts hovers around 0.05%. This is quite low. It reflects the overall market trends. Many traditional banks offer rates close to this average.

For example:

| Bank Type | Interest Rate |

|---|---|

| Traditional Banks | 0.01% – 0.05% |

| Credit Unions | 0.05% – 0.10% |

These rates are not ideal for growing your savings.

Bank-specific Rates

Different banks offer different rates. Here are some examples:

- Bank of America: 0.01%

- Wells Fargo: 0.01%

- Chase Bank: 0.01%

These banks offer the lowest rates. They are among the least profitable options.

Consider exploring online banks. They often offer higher rates.

For instance:

| Bank | Interest Rate |

|---|---|

| Ally Bank | 0.50% |

| Discover Bank | 0.40% |

These rates are significantly higher. They can help your savings grow faster.

Credit: www.annuity.org

Impact Of Fees On Earnings

Savings accounts can help you earn interest on your money. But fees can reduce your earnings. Understanding these fees is crucial. Two key types of fees can impact your savings: Monthly Maintenance Fees and Transaction Fees.

Monthly Maintenance Fees

Monthly maintenance fees are charges by banks to maintain your account. These fees can range from $5 to $15 per month. Even a small fee can add up over time.

For example, a $10 monthly fee results in $120 per year. This amount can significantly reduce your annual interest earnings.

Some banks waive these fees if you meet certain criteria. These may include maintaining a minimum balance or setting up direct deposits.

Transaction Fees

Transaction fees are charges for specific account activities. These can include withdrawals, transfers, or even checking your balance.

A common fee is for exceeding a limited number of withdrawals. Federal law allows up to six withdrawals per month. Exceeding this limit can result in a $5 to $10 fee per transaction.

Other transaction fees can include ATM fees or international transfer fees. Each fee reduces your total earnings.

| Fee Type | Common Amount |

|---|---|

| Monthly Maintenance Fee | $5 – $15 per month |

| Excess Withdrawal Fee | $5 – $10 per transaction |

| ATM Fee | $2 – $5 per transaction |

Monitoring these fees can help you choose the best savings account. Always read the terms and conditions to understand all potential fees.

Choosing The Right Account

Finding the right savings account can be tricky. Some accounts earn you less money. Knowing which account fits your needs is key. Let’s explore how to choose wisely.

Personal Financial Goals

Your personal financial goals matter a lot. Do you want to save for a short term goal? Or are you looking at long-term savings? Your goals will guide your choice.

If you want quick access to your money, choose an account with easy withdrawals. For long-term goals, pick an account with higher interest rates. Always align your account choice with your financial aims.

Account Accessibility

Account accessibility is crucial. Some accounts limit how often you can withdraw money. Others offer more flexibility but lower interest rates.

Check if the account charges fees for withdrawals. Fee structures can eat into your savings. Always balance accessibility with earning potential.

| Account Type | Interest Rate | Accessibility |

|---|---|---|

| Basic Savings Account | Low | High |

| High-Yield Savings Account | High | Medium |

| Money Market Account | Medium | High |

| Certificate of Deposit (CD) | Highest | Low |

Each account type serves different needs. Choose wisely based on your goals and accessibility needs. This ensures you maximize your savings potential.

Credit: educounting.com

Credit: educounting.com

Frequently Asked Questions

What Is The Lowest-earning Savings Account Type?

Basic savings accounts often earn the least interest. They offer low interest rates but are easy to open and maintain.

How Do Interest Rates Affect Savings?

Interest rates determine how much money your savings will grow. Lower rates mean lower earnings, making high-interest accounts more beneficial.

Are Online Banks Better For Earning Interest?

Online banks usually offer higher interest rates than traditional banks. They have lower overhead costs, which they pass on to customers.

Do Credit Unions Offer Better Rates?

Credit unions often provide higher interest rates compared to traditional banks. They are member-focused and not-for-profit.

Conclusion

Choosing the right savings account is crucial for maximizing your earnings. Low-interest accounts can diminish your financial growth. Always compare interest rates and account features. Opt for accounts with competitive rates and minimal fees. Make informed decisions to ensure your money works harder for you.

Your future self will thank you.